Car rental whether it has a driver or not is no longer a strange term to travel-holic people. Along with choosing the appropriate vehicle, getting the correct rental car insurance is essential to your independent travel. The requirement of rental car insurance, how to add more, and some warnings while renting a trip vehicle are all covered in this piece.

The term “rental car insurance” is not yet popular to Vietnamese travelers because most of the basic ones are included in the rental cost. However, it is good for you to know about them and their benefits to make the best decision. Additionally, there are other options which are really helpful that you should consider buying for your trip.

Some Typical Types Of Rental Car Insurance

You may pre-book car rental services for motorcycles or 4–7-seater vehicles in travel locations or opt to go independently by taxi, transit vehicles, or any of these modes of transportation. You should get familiar with the many types of insurance that are required for each kind of car.

1/ Basic liability insurance

Owners of automobiles must purchase this insurance. The driver, the car, the owner, and any third parties are all covered in case of unforeseen events by this type of insurance, which does not cover vehicles.

2/ Theft protection insurance

It is also known as complete coverage, and it serves as a means of financial defense for the advantages and legal rights of both consumers and service providers against auto theft. In order to protect the interests of both parties, providers typically include this insurance in the overall rental price.

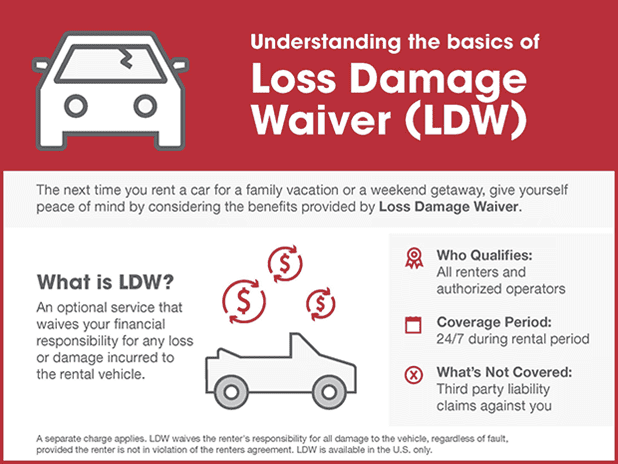

3/ Collision damage waiver

Travelers most frequently choose this type of rental automobile insurance. The bodywork of the automobile will be covered by this insurance for any damages. You are responsible for covering the cost of repairs for any additional dents on the vehicle or purchasing any necessary additional insurance.

4/ Personal accident insurance

This is another optional coverage. However, it is worth taking into account because of its coverage for medical extra costs in case of accidents.

5/ Other damage protection coverage

The car’s specific parts are covered by this insurance (except from the bodywork, which is covered by the collision damage waiver). You may, for instance, add the window and wheel insurance as needed.

THERE ARE 3 OPTIONS FOR INSURING YOUR RENTAL CAR!

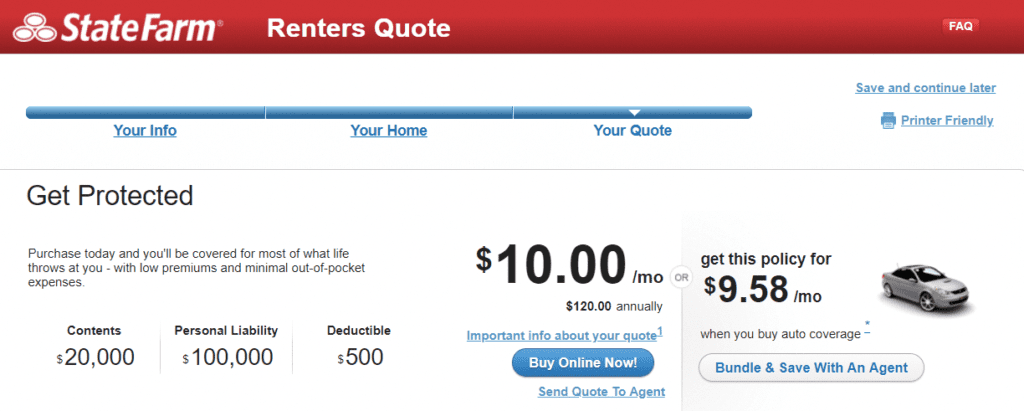

1/ Insure online when you book the rental service

Many booking apps and websites include extra insurances with vehicle rental agreements or partner with insurance providers. These protection plans were created especially for the requirements of customers and rental cars. Other automotive components are also included, in addition to the auto bodywork. Additionally, there are many different coverage packages available for both drivers and rental cars, all of which are connected to rental car insurance. As a result, choosing a suitable bundle only takes a minute.

2/ Sign with a third-party insurer

You have the option of purchasing insurance from a third-party insurance provider. There are several possibilities for both your vacation and automobile rental, so choosing the best one may take a significant amount of your time. The price for excess coverage insurance is sometimes less expensive than extra coverage from booking apps/websites or rental businesses, which is a positive in this situation.

3/ Directly buy at the rental company’s counter

Travel and rental automobile insurance is often provided by car rental agencies. This insurance, offered by reputable rental providers, is easily added and rather practical. All you have to do is visit rental agencies to pick up your vehicle and have a look at some of the offers from suppliers for their various insurance options. If you accept the offers, the amount of the coverage will be added to the rental car fee.

SOME NOTICES WHEN ADDING RENTAL CAR INSURANCES

Having rental car insurance helps you limit risks during the journey. Here are some notices that you should look over before choosing one.

1/ Search for information

Check the coverage on your individual auto insurance policy before deciding on the best insurance. Because your insurance may occasionally cover a rental vehicle as well. It implies that you might get a greater level of security for both you and your vehicle than any other coverage plan an insurance company may provide. That can really assist you in saving money for the vacation or for thinking about other necessary coverage.

2/ Read the rental contract carefully

You should carefully read the contract’s conditions, paying particular attention to the renter’s obligation and the insurance companies’ offered limits of coverage. These supplemental insurance policies are frequently used for brief periods of time and provide very few advantages to tenants. You can avoid accepting complete responsibility and settling for a significant sum of money in the event of car theft or automobile damage by reading the conditions carefully and comparing them.

3/ Check your personal coverage

Look over the terms of any existing travel insurance you may have to see if it covers rental car insurance. You can ask for more coverage if you haven’t already.

SOME RELIABLE INSURANCE COMPANIES FOR YOUR REFERENCE

For your information, the following are a few reputable insurance providers offering a wide range of insurance choices for automobiles and travel:

- Pacific Cross: Pacific Cross offers a variety of insurances, including travel insurance with specific conditions regarding costs and client rights. “Insurance deductible coverage for rental automobiles” contains details about car rental insurance.

- Cathay: Similar to Pacific Cross, Cathay is a non-life insurance provider that gives customers a wide range of alternatives and detailed purchasing guidelines.

- Liberty: This insurance provider solely offers coverage for vehicles, thus both the protection of drivers’ rights and the payment for damage are clearly at the forefront of their insurance offerings.

- MIC: Due to its positive reputation for automobile rental insurances, MIC is currently a partner to several well-known car rental services/platforms.

- Misg: You can find various suitable car rental coverage with a detailed price list.

RECOMMENDATIONS

You should look for rental car insurance before your trip, then get the best level of protection for both you and your rental automobile. Your travel will go more smoothly and make you feel more at ease. Before selecting the appropriate insurance, consider the following considerations:

- Is it actually regulated insurance?

- Does your travel insurance include rental car coverage?

- Does your personal coverage extend to rental cars?

- Does suggested coverage from rental companies cover your luggage and personal items?

- Does the insurance package you tend to buy cover other car parts apart from the bodywork?