When you have travel insurance, whether it is for delayed flights or lost passports, traveling is more fun. We’ll provide you some clear advice on how to get travel insurance when visiting Vietnam in order to provide you with comprehensive coverage in case of emergencies or hassles.

I/ What is travel insurance?

Travel insurance is regarded as a financial strategy for risk management and loss prevention during your vacation. Insurance companies will compensate you specifically in these situations as well as for any problems relating to medications and other costs incurred during the trip.

II/ Should you buy travel insurance?

Like any type of insurance, travel insurance helps you to secure your travel. The volume of repay policy and benefits will be different based on what companies and the coverage you chose. These information below helps you to answer the questions.

III/ Cases are covered by travel insurance

There are 5 common cases during the journey that you can complain:

1. Trip cancellation

Insurance providers will refund the money you purchased in advance for flights, lodging, or travel tickets if you have to unexpectedly alter or cancel your trip. However, the insurance is only effective if the policy specifically addresses your reasons for canceling. For instance, you become sick and can’t go on vacation, or there are natural disasters where you’re going.

2. Accidents and medical emergencies

Accidents and injuries sustained when traveling are common, especially while engaging in physically demanding activities. When traveling overseas, medical bills can be quite expensive if you contract food poisoning or experience other health problems. Those issues can be covered by an insurance policy.

3. Loss luggage

Both local and international travel carry the possibility of missing luggage. In this scenario, travel insurance with luggage coverage will reimburse you for any lost or stolen belongings with the appropriate sum of money.

4. Missed departure time

Missed trains or flights may cause you a lot of problems and cost you a lot of money to purchase replacement tickets. When certain conditions outlined in the policy apply to you, having missing connection travel insurance might help you get compensated.

5. Travel delays

Missed connections or scheduled travel activities may be the result of travel delays. If that happens, a policy with travel delay coverage may be able to compensate you for unused travel costs, such as nonrefundable, pre-paid tickets for flights and lodging.

IV/ YOU SHOULD BUY TRAVEL INSURANCE!

Unexpected incidents during the journey might be reduced with a thorough schedule. You should, however, give obtaining travel insurance considerable consideration because hazards are unpredictable. The wise choice is to purchase travel insurance.

Who should buy travel insurance?

Depending on the company’s rules, a wide variety of persons, from 6 weeks old to 85 years old, are covered by travel insurance. You may buy travel insurance if you fall under one of the following categories of travellers:

| Broad travel | Traveling internationally frequently entails more dangers than domestic travel, including the possibility of losing personal belongings and money. Therefore, it is important to consider appropriate coverage if you often travel overseas. |

| Valuable trip | You should purchase travel insurance if you had planned and pre-booked a lavish trip that included an expensive resort, nonrefundable flights, and a 5-star cruise. The coverage will pay all of your expenses if you have to cancel your vacation and the prepaid services refuse to reimburse you. |

| Challenge activities included in the trip | Visitors from all over the world are drawn to physical challenge activities and excursions to explore caves, jungles, and waterfalls, yet there is also the risk of injury. Insurance firms frequently suggest this form of coverage despite the fact that it is not required due to its need. |

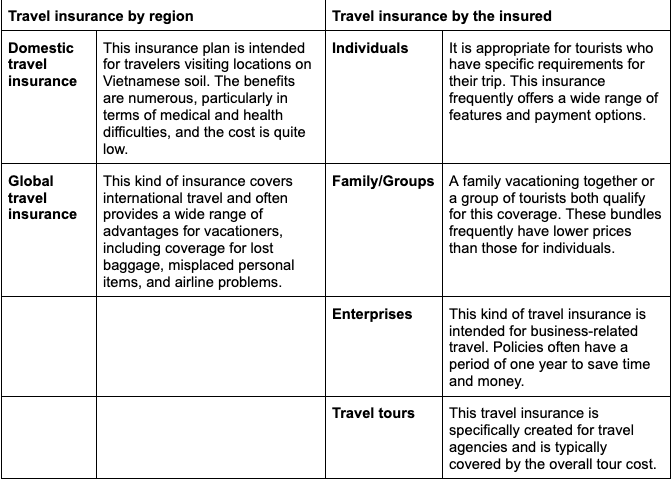

Some popular types of travel insurance

Travel coverage is usually classified based on region and the insured.

Some notices for buying travel insurance

- Not every trip needs travel insurance

Here’s a tip for you: if you’re planning a domestic vacation on a tight budget with no costly luggage, you could decide to forgo travel insurance. On the other hand, you should have one if the expense of your vacation as a whole is high.

- Carefully read the policies

To fully understand what is and is not covered, you should take the time to study every clause in your insurance policy. After that, you may edit or extend the list as necessary. Additionally, pick insurance providers who offer 24/7 help so you can get in touch with them whenever you need to.

- Try not to overlap

It may be necessary to review the policies of any existing life or medical insurance to ensure that you won’t be required to pay for the same benefit again. For instance, if you become sick or have an accident while traveling, your medical insurance could pay the hospital bills.

- You might need to buy it soon

You should get travel insurance, or at the absolute least coverage with a cancellation policy, as soon as you have planned and reserved every service for the trip. In the case that you must cancel, the insurance provider may pay you.

- Don’t fall for tourist traps

Remember that you must carefully read the policy to determine what you want covered in order to avoid falling victim to sales tactics with additional terms. Additionally, you must take away the advantages you previously enjoyed.

Some reliable travel insurance in Vietnam

Numerous reputable insurance providers in Vietnam provide all-inclusive services for vacations, business trips, and international studies. Some trustworthy ones are:

1/ Bao Viet

Baoviet TravelCare is your dependable travel companion since it offers a variety of coverage options that are affordable for tourists. One of Baoviet’s most notable products, Global Travel Insurance Flexi, is created for individuals and Saigontourist clients.

2/ Bao Minh

With 22 compensating advantages, Bao Minh is recognised for offering several insurance packages for local and international travel, which are suitable for requesting a global visa.

3/ VNI

The Vietnam National Aviation Insurance Corporation offers domestic and international coverage for both people and businesses. In case of unforeseen circumstances, VNI will refund you the sum specified in the insurance certificate.

4/ Chubb

TripCARE, the all-inclusive travel insurance for Vietnam Airlines passengers, is a well-known product of Chubb and PVI.

5/ BIC

BIC is a subsidiary company under BIDV (government bank), support all clients from 1 to 70 years with cases like accidental death, dismemberment, medical assistance, as well as any trip problems

6/ AIG

Having insurance, AIG’s Travel Guard provides a variety of options that come with a ton of perks and expert compensation services.

7/ Liberty

The insurance products offered by the Liberty Company are very diverse. Insurance for international travel TravelCare is well known for its extensive coverage for both solo and group travellers.

As you can see, virtually all insurance providers provide suitable local and international coverage options. On certain items, each company has an advantage over the competition, but all of their solutions are geared on enhancing the advantages of their clients.

This is a description of travel insurance. You should learn more about the significance of travel insurance for your trip from this post and be able to select the most appropriate policy with more ease.